1964 Began self-education on financial markets, investing, and economics.

“I never even thought about finance until I was 32.”

Tren Griffin. A Dozen Lessons on Investing from Ed Thorp [Blog Post]. 25iq My Views on the Market, Tech, and Everything Else, July, 2017

56. THE SPECULATIVE MERITS OF COMMON STOCK WARRANTS AND HANDWRITTEN NOTE.

Sidney Fried. R. H. M. Associates. 1954. UCI Libraries Special Collections and Archives, Edward O. Thorp Papers.

1965 Began teaching at UC Irvine as founding member of the Mathematics Department.

1966 Co-authored Beat The Market: A Scientific Stock Market System with Dr. Sheen Kassouf, a founding faculty member of the UC Irvine Department of Economics. This book in part motivated Fischer Black and Myron Scholes to prove an identical formula, the Black–Scholes model, which received the Nobel Prize in Economics.

57. BEAT THE MARKET: A SCIENTIFIC STOCK MARKET SYSTEM.

Edward O. Thorp, Sheen Kassouf. Random House, 1967.

1967 Had a theoretical breakthrough to arrive at a neat formula for determining the “correct” price of a stock’s warrant, i.e., a security issued by a company that gives the owner the right to buy stock at a specified price. Began to manage hedged portfolios for clients.

Became acquainted with Warren Buffet through Ralph Waldo Gerard who became Dean of the Graduate Division at UC Irvine.

1968 Became acquainted with Warren Buffet through Ralph Waldo Gerard who became Dean of the Graduate Division at UC Irvine.

1969 Launched Convertible Hedge Associates, renamed in 1974 to Princeton Newport Partners, with stockbroker Jay Regan. A bicoastal operation, the Newport Beach office was the think tank and trade generator, and New York the business office and trading desk.

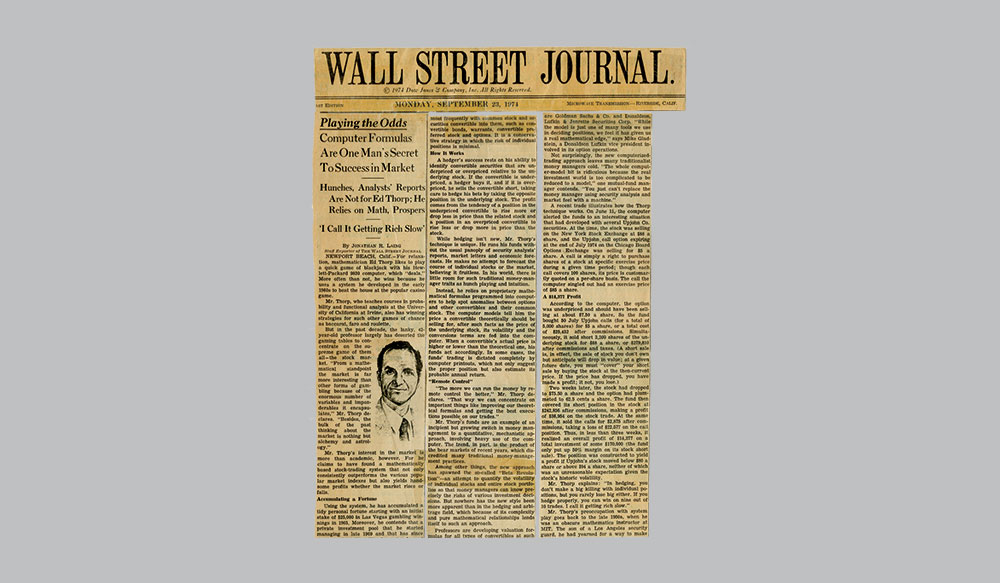

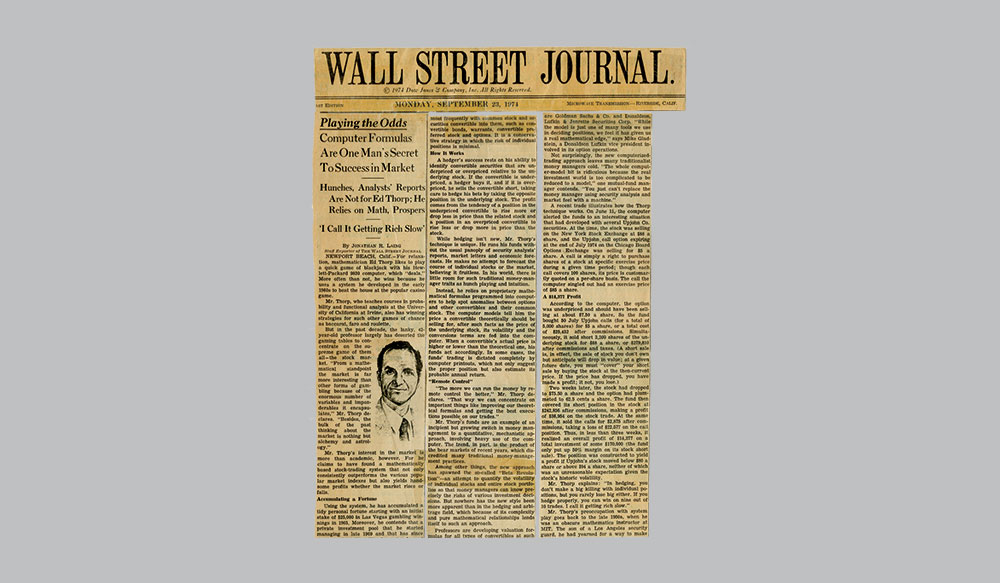

58. “PLAYING THE ODDS: COMPUTER FORMULAS ARE ONE MAN’S SECRET TO SUCCESS IN MARKET.”

Jonathan R. Laing. Wall Street Journal. 1974, September 23. UCI Libraries Special Collections and Archives, Edward O. Thorp Papers.

1979 10th anniversary of Princeton Newport Partners, at which point it was up 409% for the decade. Its original $1.4 million capital base had grown to $28.6 million.

1982 Edward O. Thorp concluded working as a full professor at UCI to “…focus on competing with the wave of mathematicians, physicists, and financial economists who were now flocking to Wall Street from academia.”

Click here for a High Res readable PDF

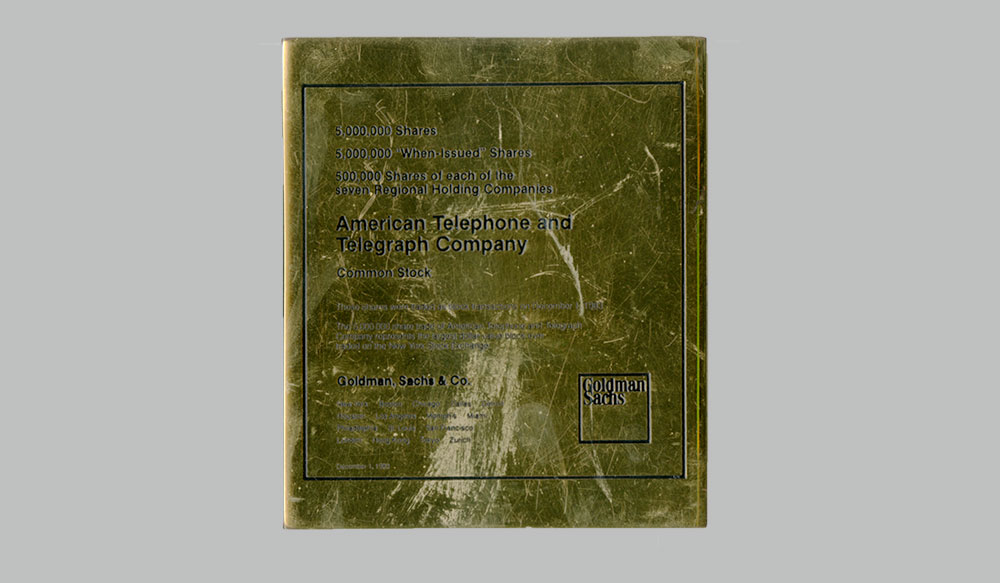

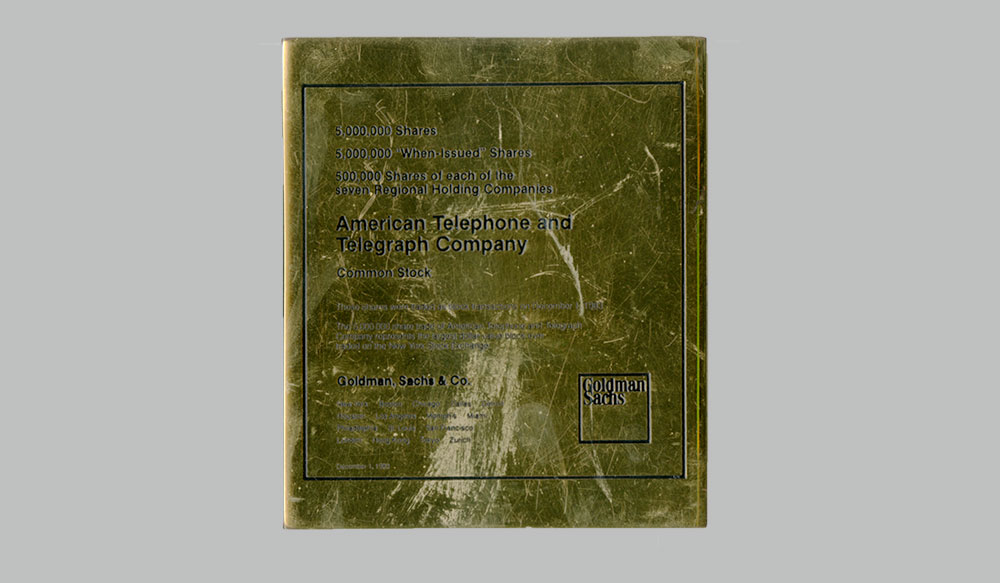

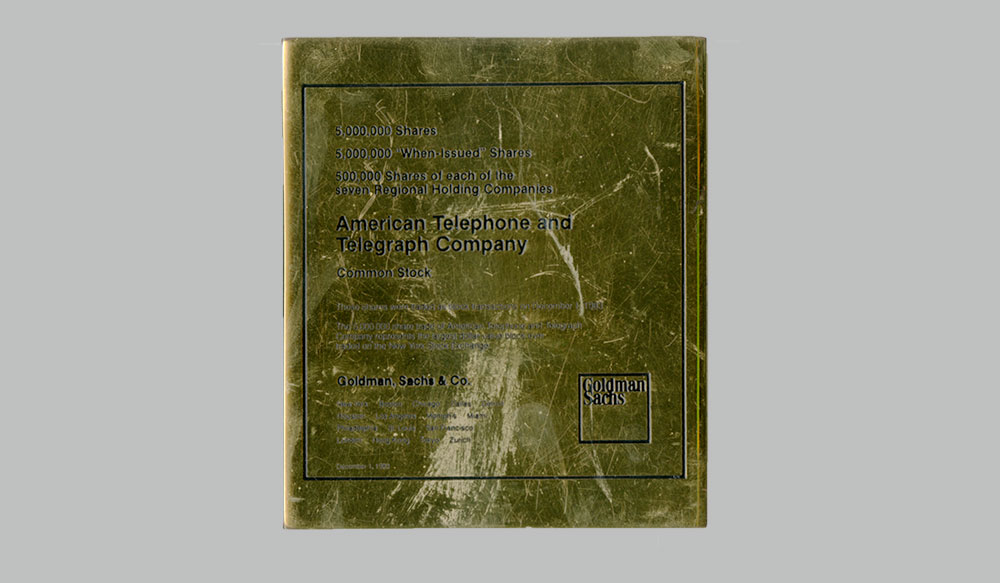

1983 Princeton Newport Partners pioneered new trades, including a huge one-time trade that took place as AT&T was divided into a new company. This trade, on December 1, 1983 was at the time the largest dollar amount for a single trade in the history of the New York Stock Exchange.

59. BRASS ENGRAVED DEAL TROPHY OF TRANSACTION. Courtesy of Edward O. Thorp.

1987 Launched a family office called Edward O. Thorp & Associates.

1988 Closed Princeton Newport Partners. Its original $1.4 million capital base had grown to $273 million, with investment positions totaling $1 billion.

60. “BEAT THE DEALER.” William Baldwin. Forbes. May 5, 1986. UCILibraries Special Collections and Archives, Edward O. Thorp Papers.

Click here for a High Res readable PDF

1991 Discovered Bernie Madoff’s Ponzi scheme when a client asked Edward O. Thorp to review his portfolio, which included an investment with Bernard L. Madoff Investment Securities. Bernie Madoff was eventually arrested in 2008.

61. BERNIE MADOFF LEAVING COURT AFTER A BAIL HEARING IN NEW YORK CITY, 2009. Kathy Willens (photographer). Associated Press.

1994 Launched an investment partnership called Ridgeline Partners.

2002 Closed Ridgeline Partners. It gained 18% per year over its eight years of operation.

2003 Attended the Berkshire Hathaway Annual Shareholders Meeting. Edward O. Thorp originally began investing in Berkshire Hathaway Class A stock in 1982, when each share was valued at $982.50.

62. SHAREHOLDER MEETING BADGE. Courtesy of Edward O. Thorp.

2011 Edward O. Thorp co-edited The Kelly Capital Growth Investment Criterion, World Scientific Publishing Company, 2011, with Leonard C. MacLean and William T. Ziemba. The book is a compilation of academic papers on the Kelly Criterion Formula, which per Edward O. Thorp, “tells you how to allocate money between risky alternatives and gives you an idea of how much to allocate to each.”

Leslie P. Norton and Dan Lam. The Stockpicker’s Burden, and Other Lessons. Barron’s. March 19, 2018.62.

63. KELLY CAPITAL GROWTH INVESTMENT CRITERION. Leonard C. MacLean, Edward O. Thorp, William T. Ziemba (Eds.) World Scientific Publishing Company. February 11, 2011.

2017 Edward O. Thorp authored A Man for All Markets: From Las Vegas to Wall Street, How I Beat the Dealer and the Market. Random House, 2017.

64. A MAN FOR ALL MARKETS: FROM LAS VEGAS TO WALL STREET, HOW I BEAT THE DEALER AND THE MARKET. Edward O. Thorp. Random House, 2017.

1964 Began self-education on financial markets, investing, and economics.

“I never even thought about finance until I was 32.”

Tren Griffin. A Dozen Lessons on Investing from Ed Thorp [Blog Post]. 25iq My Views on the Market, Tech, and Everything Else, July, 2017

56. THE SPECULATIVE MERITS OF COMMON STOCK WARRANTS AND HANDWRITTEN NOTE.

Sidney Fried. R. H. M. Associates. 1954. UCI Libraries Special Collections and Archives, Edward O. Thorp Papers.

1965 Began teaching at UC Irvine as founding member of the Mathematics Department.

1966 Co-authored Beat The Market: A Scientific Stock Market System with Dr. Sheen Kassouf, a founding faculty member of the UC Irvine Department of Economics. This book in part motivated Fischer Black and Myron Scholes to prove an identical formula, the Black–Scholes model, which received the Nobel Prize in Economics.

57. BEAT THE MARKET: A SCIENTIFIC STOCK MARKET SYSTEM.

Edward O. Thorp, Sheen Kassouf. Random House, 1967.

1967 Had a theoretical breakthrough to arrive at a neat formula for determining the “correct” price of a stock’s warrant, i.e., a security issued by a company that gives the owner the right to buy stock at a specified price. Began to manage hedged portfolios for clients.

Became acquainted with Warren Buffet through Ralph Waldo Gerard who became Dean of the Graduate Division at UC Irvine.

1968 Became acquainted with Warren Buffet through Ralph Waldo Gerard who became Dean of the Graduate Division at UC Irvine.

1969 Launched Convertible Hedge Associates, renamed in 1974 to Princeton Newport Partners, with stockbroker Jay Regan. A bicoastal operation, the Newport Beach office was the think tank and trade generator, and New York the business office and trading desk.

58. “PLAYING THE ODDS: COMPUTER FORMULAS ARE ONE MAN’S SECRET TO SUCCESS IN MARKET.”

Jonathan R. Laing. Wall Street Journal. 1974, September 23. UCI Libraries Special Collections and Archives, Edward O. Thorp Papers.

1979 10th anniversary of Princeton Newport Partners, at which point it was up 409% for the decade. Its original $1.4 million capital base had grown to $28.6 million.

1982 Edward O. Thorp concluded working as a full professor at UCI to “…focus on competing with the wave of mathematicians, physicists, and financial economists who were now flocking to Wall Street from academia.”

Click here for a High Res readable PDF

1983 Princeton Newport Partners pioneered new trades, including a huge one-time trade that took place as AT&T was divided into a new company. This trade, on December 1, 1983 was at the time the largest dollar amount for a single trade in the history of the New York Stock Exchange.

59. BRASS ENGRAVED DEAL TROPHY OF TRANSACTION. Courtesy of Edward O. Thorp.

1987 Launched a family office called Edward O. Thorp & Associates.

1988 Closed Princeton Newport Partners. Its original $1.4 million capital base had grown to $273 million, with investment positions totaling $1 billion.

60. “BEAT THE DEALER.” William Baldwin. Forbes. May 5, 1986. UCILibraries Special Collections and Archives, Edward O. Thorp Papers.

Click here for a High Res readable PDF

1991 Discovered Bernie Madoff’s Ponzi scheme when a client asked Edward O. Thorp to review his portfolio, which included an investment with Bernard L. Madoff Investment Securities. Bernie Madoff was eventually arrested in 2008.

61. BERNIE MADOFF LEAVING COURT AFTER A BAIL HEARING IN NEW YORK CITY, 2009. Kathy Willens (photographer). Associated Press.

1994 Launched an investment partnership called Ridgeline Partners.

2002 Closed Ridgeline Partners. It gained 18% per year over its eight years of operation.

2003 Attended the Berkshire Hathaway Annual Shareholders Meeting. Edward O. Thorp originally began investing in Berkshire Hathaway Class A stock in 1982, when each share was valued at $982.50.

62. SHAREHOLDER MEETING BADGE. Courtesy of Edward O. Thorp.

2011 Edward O. Thorp co-edited The Kelly Capital Growth Investment Criterion, World Scientific Publishing Company, 2011, with Leonard C. MacLean and William T. Ziemba. The book is a compilation of academic papers on the Kelly Criterion Formula, which per Edward O. Thorp, “tells you how to allocate money between risky alternatives and gives you an idea of how much to allocate to each.”

Leslie P. Norton and Dan Lam. The Stockpicker’s Burden, and Other Lessons. Barron’s. March 19, 2018.62.

63. KELLY CAPITAL GROWTH INVESTMENT CRITERION. Leonard C. MacLean, Edward O. Thorp, William T. Ziemba (Eds.) World Scientific Publishing Company. February 11, 2011.

Explore the exhibit contents:

- Introduction

- A Natural Talent (Items 1-12)

- A Winning Hand (Items 13-23)

- Beat the House (Items 24-33)

- A Spin of the Wheel (Items 34-44)

- Higher Mathematics at UCI (Items 45-55)

- A Career in Quantitative Finance (Items 56-64)

- Tips from the Master

- Newport Life & Philanthropy (Items 65-70)

- Bonus: Online-Exhibit Exclusive!